Deals in 2022 may have dipped from the peaks of 2021 – but not by much

Independent specialist insurance and reinsurance broker BMS has released the latest edition of its global private equity, M&A, and tax (PEMAT) report, which analyses 2022 trends and provides an outlook for 2023 in the European, North American, and Asian M&A markets.

M&A transaction volumes dropped significantly following the record-high levels achieved through 2021 and early 2022. BMS’s PEMAT report identified key events which informed these results as well as the general M&A market last year, including the pandemic, the Russia-Ukraine conflict, inflation and the elevated interest rates used to curb it, as well as concerns about recession and the risk of another banking crisis.

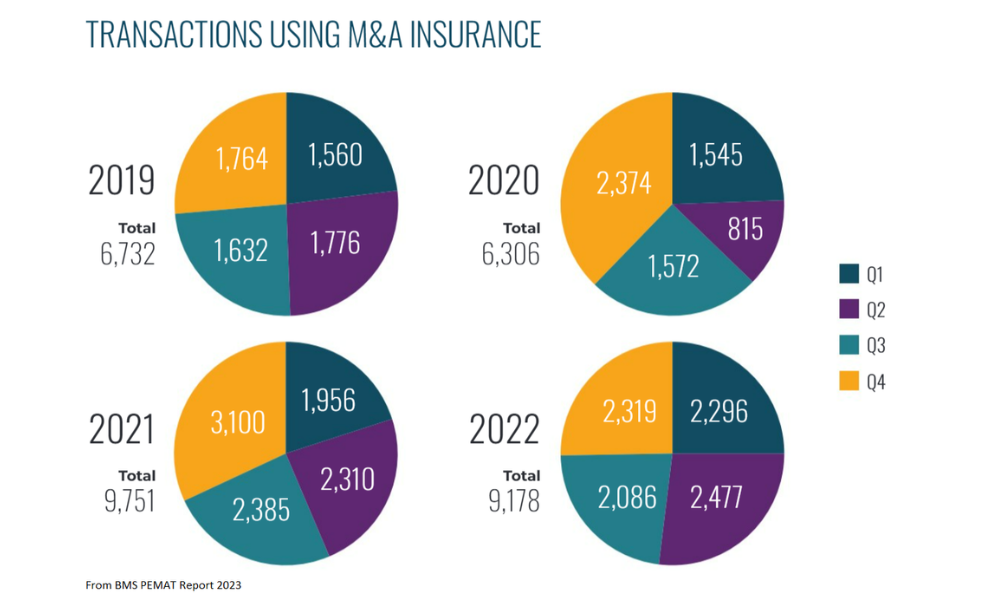

Despite the challenging macroeconomic landscape, however, 2022 saw the number of deals using M&A insurance nearly match the record-high deal volume of 2021. The 9,751 deals recorded in 2021 dipped to a still-significant 9,178 transactions in 2022, compared to the number of deals in 2019 and 2020 – under 7,000 per year.

Infrastructure and renewables were the most resilient sectors of those monitored by BMS, recording an 8.7% annual increase in deals using M&A insurance in 2022. Still, almost 20% of all deals using M&A insurance in 2022 happened in the technology, media, and telecom (TMT) sector. The infrastructure and renewables sectors accounted for 16.57% of all deals using M&A insurance, followed by other sectors (16.21%), industrials and manufacturing (14.63%), real estate (11.60%), and finally the financial and professional services sectors (8.51%).

The 2022 deal size also dipped, affected by the deceleration in M&A activity and rise in interest rates. Insurers noted a reduction in average enterprise value as investors became less able to commit to high deal multiples.

BMS observed a 40% growth in insurance products purchased over the past 24 months, showing that a growing appetite remained in the M&A insurance market, and an uptick in claims from policies underwritten pre-2022 M&A boom.

On the other hand, BMS found no significant rise in distressed M&A targets. Instead, the short-term macroeconomic impact of COVID-19 had gradually disappeared throughout 2022. Although European M&A activity weakened in the second half of 2022, the tax insurance market saw a record number of enquiries.

Looking forward, BMS remained optimistic that M&A deals would see a resurgence towards the second half of 2023, although a potential global recession in 2023 could cause the number of distressed sales to shoot up.

“Whilst 2023 has got off to a subdued start in comparison to the deal activity levels seen over the last two years, delayed processes are gaining momentum and we have received the same number of enquiries as compared to 2022,” said BMS head of private equity and M&A Tan Pawar in his welcome and outlook to the BMS PEMAT report. “The expectation that interest rates have [stabilized] should mean that acquirers gain confidence in pricing debt into bids, with [sellers’] expectations on multiples being reset, leading to a resurgence in deals signing in Q2 onwards.”