Survey compares benefits packages for general, senior, and managing counsel

BarkerGilmore has gathered the latest compensation data for in-house counsel and compliance officers across the U.S. in its 2023 private equity and portfolio company in-house counsel compensation report.

The boutique executive search firm, which specialises in building legal and compliance departments for companies across various industries and practice areas, administered an online survey last March 2023 in order to collect compensation information from a random sample of private equity and portfolio company professionals in the U.S. and has just published the results.

“As the private equity space continues to grow, we are seeing consistent demand for lawyers and compliance officers at both the firm and portfolio company level,” founding partner John Gilmore said. “This is generating a noticeable impact on compensation and responsibilities for these professionals. BarkerGilmore’s report emphasises the opportunities and rewards for general counsel, chief compliance officers, managing counsel, and senior counsel as they navigate the realm of private equity, serving as legal experts and strategic business advisors.”

Gilmore and managing partner Bob Barker also said that a look at updated and comparative compensation data enabled companies to make informed decisions regarding their compensation strategies and helped them attract and retain top talent.

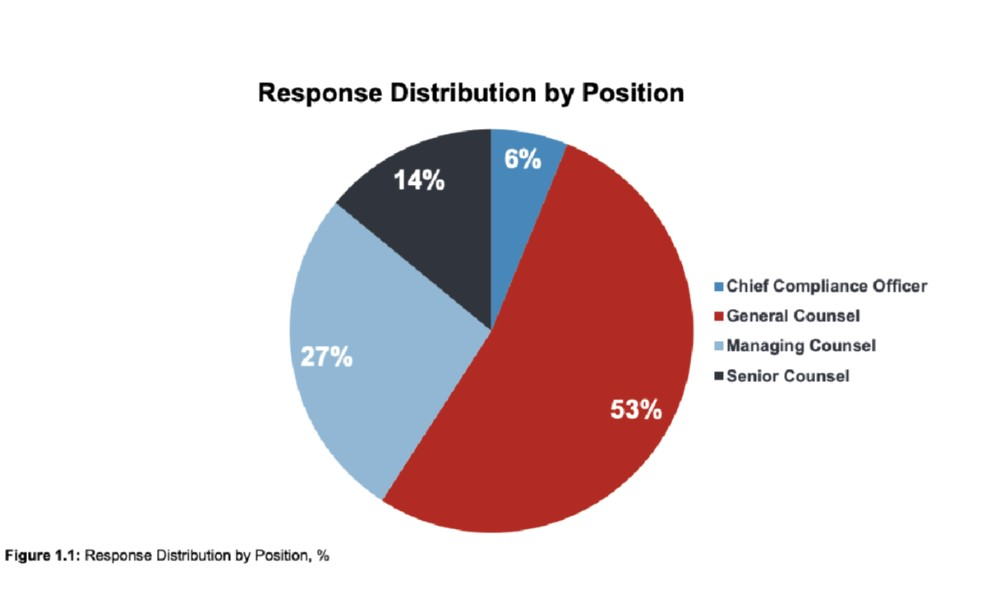

The majority of respondents were general counsel (53%). Two in three of the participating respondents – who were their organisation’s general counsel, senior counsel, managing counsel, or chief compliance officers – were male (65%), while only one in three identified as female (35%).

Key findings from the in-house counsel compensation report for those working in portfolio companies included:

The in-house compensation report also separately charted its findings for counsel in private equity companies. Key findings included: